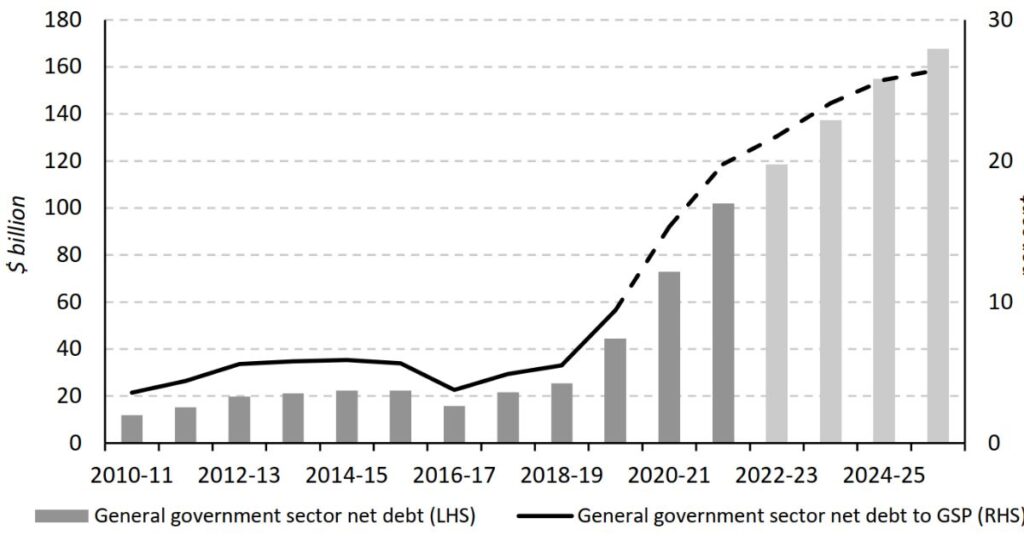

The recently released quarterly financial report for the period ending September 30, 2024, reveals a staggering increase in Victoria’s net debt.

The figures show that the state’s debt has reached $140.6 billion, marking a substantial rise from the $133.2 billion recorded just three months earlier on July 1.

This $7.4 billion increase in such a short span has sent shockwaves through the financial community and raised questions about the state’s fiscal management.

Factors Behind the Debt Increase

Several factors have contributed to this dramatic surge in Victoria’s net debt:

- Increased Borrowings: The government attributes the majority of the debt increase to a rise in borrowings. This suggests that the state is relying heavily on loans to finance its operations and projects.

- Health Sector Spending: A significant portion of the increased expenses is directed towards the health sector, reflecting the ongoing challenges in healthcare management and potential COVID-19 related costs.

- Employee Wages: The report indicates a rise in remuneration and associated costs, aligning with recent enterprise agreement outcomes.

- Interest Expenses: With additional borrowings and higher interest rates, the state is facing increased interest expenses, further straining its financial resources.

Impact on State Finances

The financial report paints a complex picture of Victoria’s fiscal health:

- Quarterly Deficit: Despite an improvement from the previous year, the state still recorded a deficit of $1.7 billion for the quarter.

- Revenue Increase: Total revenue reached $23.2 billion, with tax revenue showing a notable increase, particularly in land transfer duty and payroll tax.

- Interest Repayments: The government spent over $1.5 billion on interest repayments alone, highlighting the growing burden of debt servicing.

Government Response and Opposition Criticism

Premier Jacinta Allan has emphasized the need to view these figures in context, stating that the quarterly update represents only a portion of the financial year. The government maintains that it has a strong fiscal strategy in place and is focused on job creation and economic growth.

However, the opposition has been quick to criticize the government’s financial management. Shadow Finance Minister Jess Wilson expressed concern over the rapidly deteriorating financial position, claiming that the government lacks a plan to address the damage caused by what she terms a “decade of mismanagement.”

Long-term Implications and Challenges

The escalating debt poses several challenges for Victoria:

- Debt Sustainability: With net debt growing at an alarming rate, questions arise about the state’s ability to sustain and eventually reduce this debt burden.

- Future Investments: High debt levels may limit the government’s capacity to invest in crucial infrastructure and public services.

- Economic Growth: Balancing debt reduction with the need to stimulate economic growth will be a delicate task for policymakers.

- Credit Rating: There are concerns that continued debt increase could negatively impact Victoria’s credit rating, potentially leading to higher borrowing costs in the future.

FAQs:

What is Victoria’s current net debt?

Victoria’s net debt has reached $140.6 billion as of September 30, 2024.

How much did Victoria’s debt increase in the last quarter?

The state’s debt increased by approximately $7.4 billion in the three months leading to September 30, 2024.

What are the main factors contributing to Victoria’s debt increase?

The main factors include increased borrowings, higher health sector spending, rising employee wages, and increased interest expenses.